how do i pay my personal property tax in richmond va

For additional information visit Department of Finance website or call 804 501-4263. The assessed value is multiplied by the appropriate tax rate.

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

If the information shown is incorrect press the Return to Search button.

. The owner of the vehicle cannot renew tags state. Personal property tax bills have been mailed are available online and currently are due June 5 2022. Taxpayers can either pay.

How do I pay my personal property tax in Richmond VA. Total Bill Screen - The full amount due is. Boats trailers and airplanes are not prorated.

This program allows the city to notify the Virginia Department of Motor Vehicles electronically when a citizen fails to pay property taxes. Check or money order. The personal property tax is calculated by multiplying the assessed value by the tax rate.

A service fee is added to each payment you make with your card. How is the personal property tax calculated. You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. With an average effective property tax rate of 080 Virginia property taxes come in well below the national average of 107.

The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for. Since home values in many parts of Virginia are very high. The personal property tax rate is.

Based on the type of payments you want to make you can choose to pay by these options. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. Personal Property Tax.

Directly from your bank account direct debit ACH credit initiated from your. Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to. If not click the Back button on your web browser or click the Personal Property Tax link on the left side of the screen and reenter your ticket data.

Total Bill Screen - The full amount due is. To pay the current Personal Property bill only or to add a bill using another Web application press the Checkout button. If not click the Back button on your web browser or click the Personal Property Tax link on the left side of the screen and reenter your ticket data.

The current rate is 315 per 100 of assessed value.

Alameda County Ca Property Tax Calculator Smartasset

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Many Left Frustrated As Personal Property Tax Bills Increase

Pay Online Chesterfield County Va

Property Taxes How Much Are They In Different States Across The Us

Population Wealth And Property Taxes The Impact On School Funding

Calculating Personal Property Tax Youtube

How To Find Tax Delinquent Properties In Your Area Rethority

Why Are My Property Taxes Higher Than My Neighbor S Credit Com

The Hidden Costs Of Owning A Home

Property Taxes By State Quicken Loans

Population Wealth And Property Taxes The Impact On School Funding

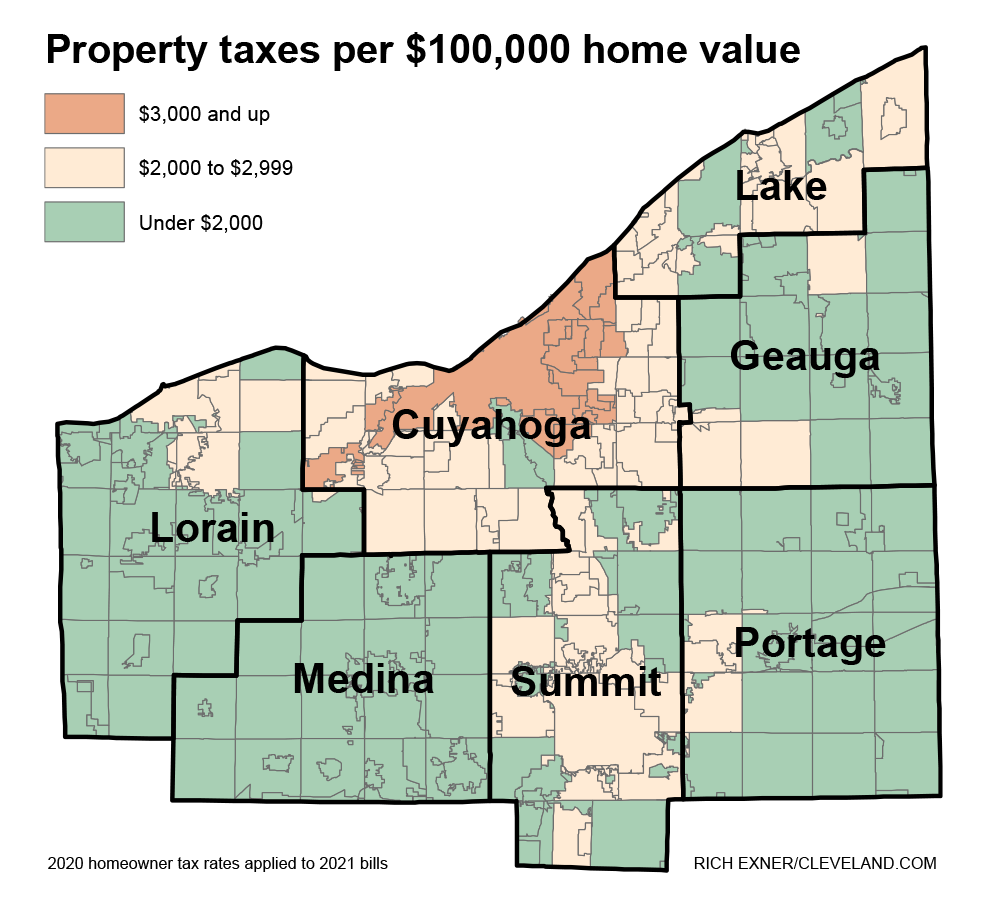

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

How School Funding S Reliance On Property Taxes Fails Children Npr

Richmond Property Tax 2021 Calculator Rates Wowa Ca

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

New York State Nys Property Tax H R Block

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5